|

Projects > Uganda_CWM: Sep12-Jun19 &

Nov19-today

|

|

|

|

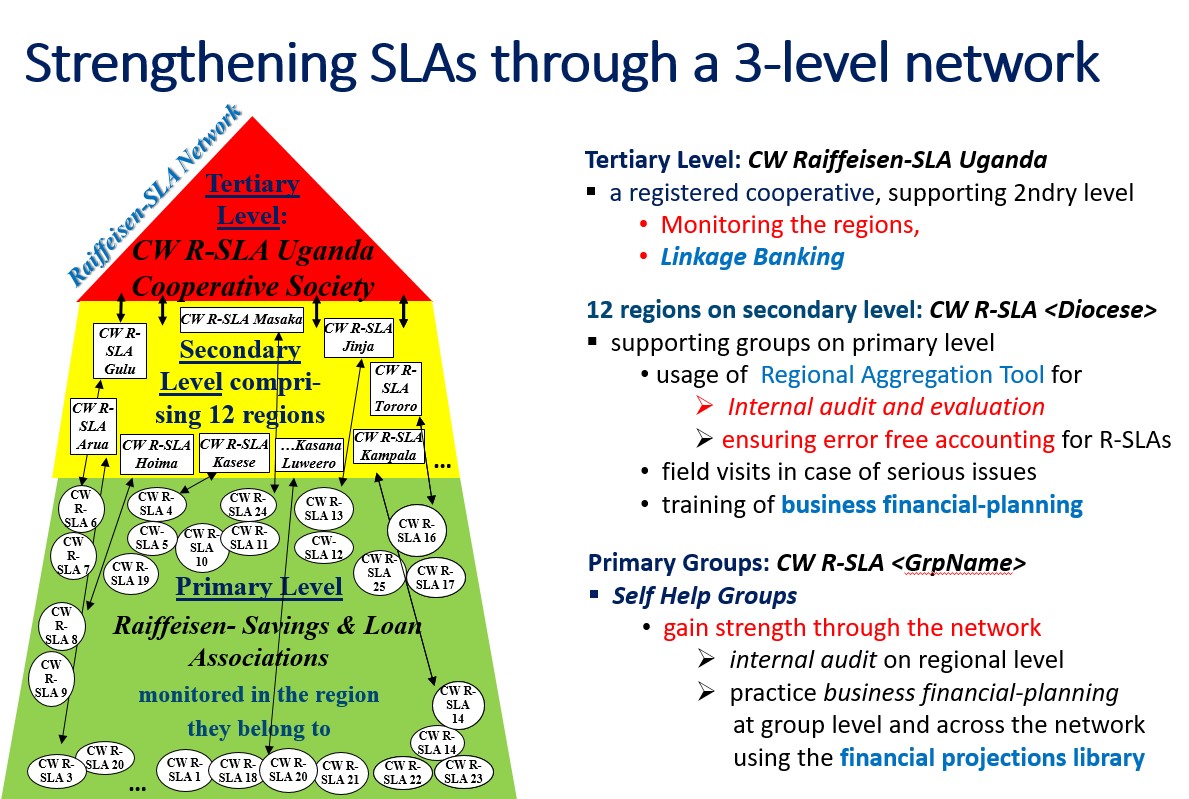

The Ugandan

Catholic Workers Movement (CWM), a country-wide-wide operating social

& church association has been founded in 1995 in the diocese Masaka and

is now active in 12 out of the 19 dioceses. Each CWM member belongs to one

Base Group on primary level. The groups are supported through voluntary

Diocesan Executive Committees (DEXCOs) on secondary level and a voluntary

National Executive Committee (NEXCO) on tertiary level. Since 2013 between

10 -20 members within one Base Group each can form a Catholic Workers

Raiffeisen-Savings & Loan Association (CW R-SLA) as soon as an in-house

CW-trainer is available.

The members save bi-weekly and take or repay loans every four weeks from the savings plus retained earnings fund following

|

strict rules as in Village SLAs (www.vsla.net). The original VSLA methodology has been slightly adjusted and enhanced with the following fundamental principles. A county-wide three-level

network of CW Raiffeisen-SLAs featuring:

·

Monthly internal audit, self-monitoring & evaluation on all three levels

·

Business

financial-planning for each loan request

·

Linkage Banking with Centenary

Bank Uganda

·

Measurable

services paid for by the groups

·

Regional trainings of CW R-SLA trainers and internal auditors by the coordinator on tertiary level

|

|

|

|

The federation

is built in analogy to the DGRV-German Cooperative and Raiffeisen

Confederation

|

|

Monitoring of 1st generation of trainers

|

Training of 1st generation of Analysts =

Auditors

|

|

|

|

|

|

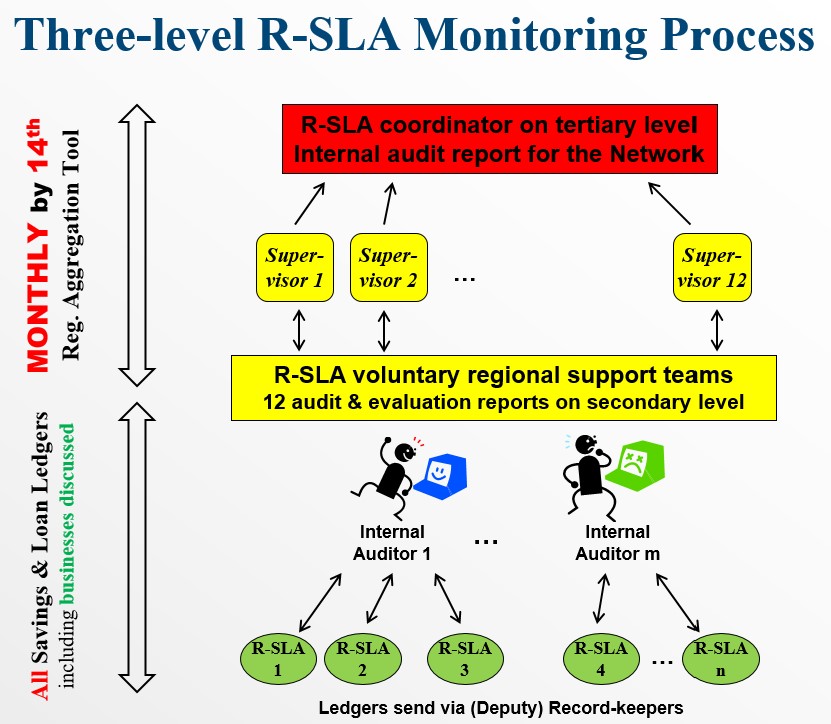

I.

The Deputy record-keeper copies entries from pass-books and notebook (loan fund at hand & bank, ...) into the group’s digital* savings- & loan ledgers and sends it to the regional R-SLA Support Team

II.

If needed regional team corrects mistakes

high-lighted in the digital

ledger and reads financial & business report into Regional Aggregation Tool

III.

R-SLA coordinator establishes the internal audit report on tertiary

level from all the regional reports submitted.

*See Recent Developments below:

If deputy

record keeper owns a smartphone, she/he copies the hand-written ledger

entries into its simple electronic version from where the

internal auditor reads them into the “Digital Ledger” with automated audit features and financial reports.

|

|

|

Business

financial-planning is taught by the CW-SLA trainer with the Cost-Income Template of the Financial

Projections Tool which is based

on unit pricing. The group learns how to quantify each item needed for a

new/enhanced business. The members internalize the concepts through continuous application of the tool for each loan request. This self-learning process will more and more empower people at the

grass root in financial and business affairs.

|

|

|

|

|

|

|

A CW-SLA member presents his costs-income

projections to receive a

loan for his new business idea. All others reflect together, if the individual assumptions are realistic and if so

approve the loan.

|

Pilot training:

All costs and in particular the income are

estimated in the cost-income template of the financial projections tool

|

|

|

|

|

|

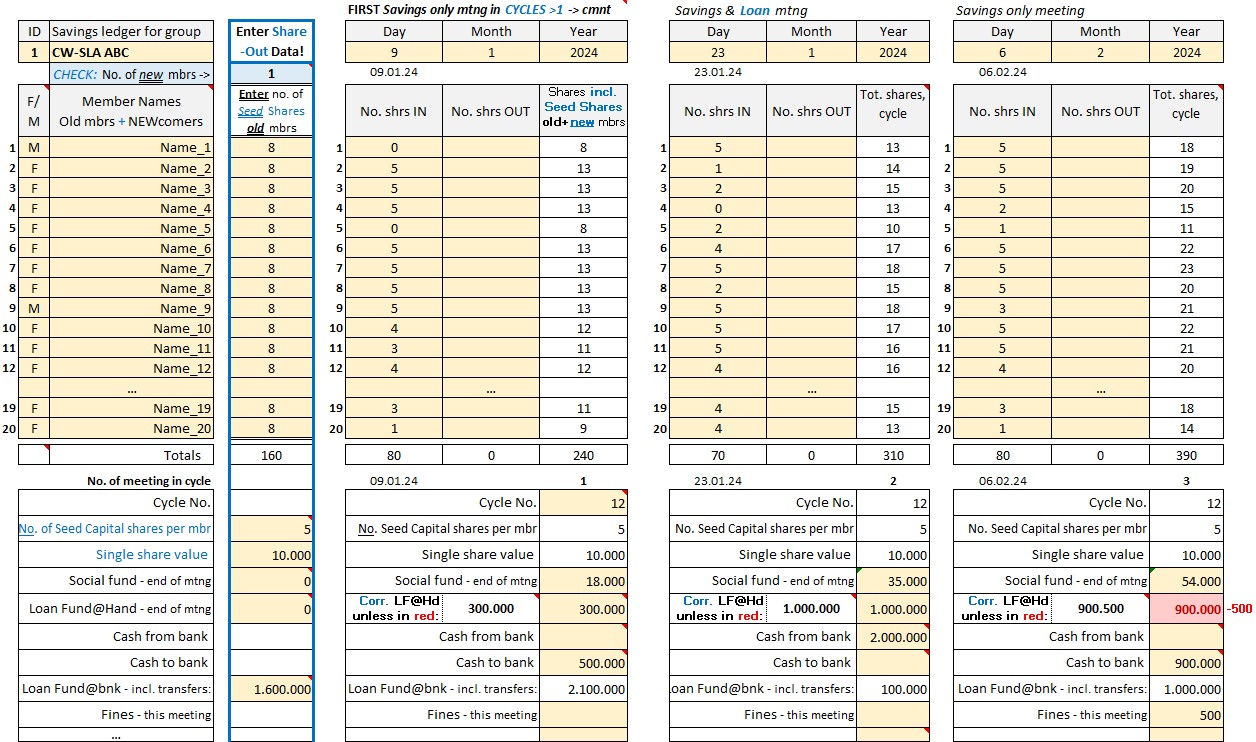

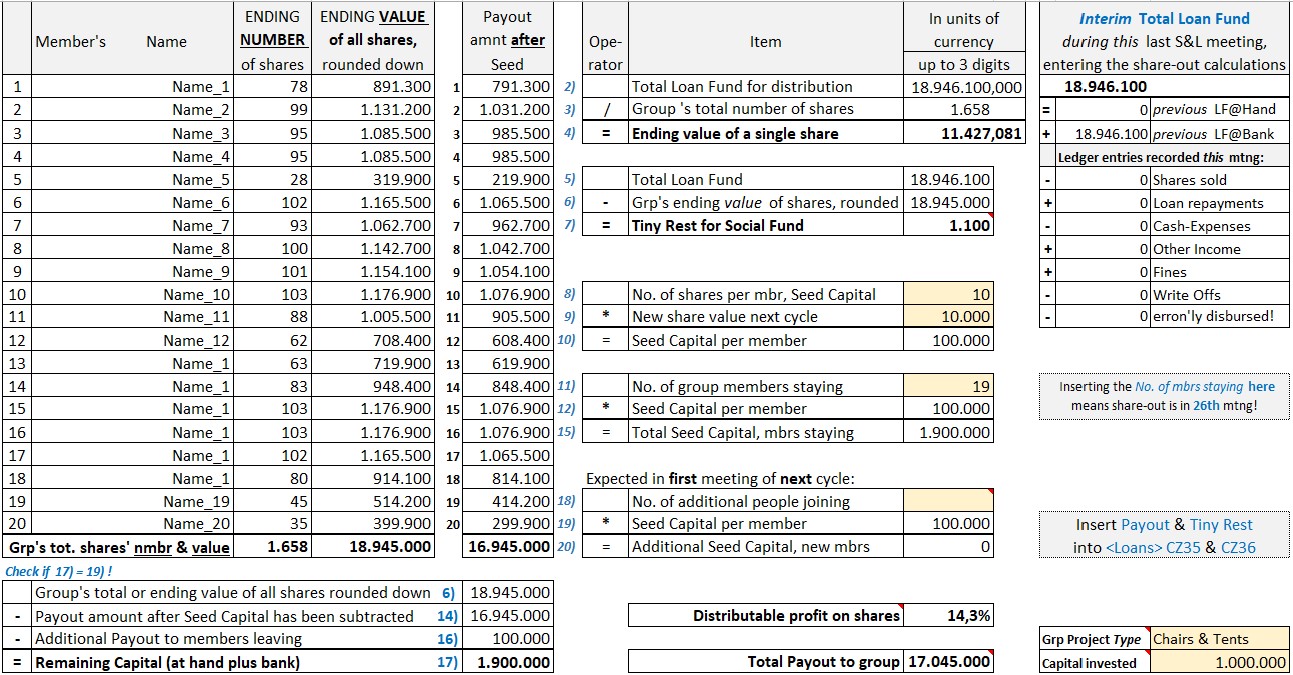

RECENT

& ONGOING DEVELOPMENTS

The three-level internal audit,

self-monitoring & evaluation system was now also digitised at the primary

level. For this the manual-written group ledgers were enhanced with an

Excel based digital ledger with fully

automated audit features and financial reports.

The Digital-Ledger is comprised out of a sheet each for all

members' flows on savings & loans including the loan fund balances, a

template for the share-out calculations as well as the monthly financial

statements over an entire group cycle ~ one year.

In case that the deputy record keeper owns a

smartphone, she/he copies the manual ledger entries into the electronic

template for the ledgers from where the internal auditor reads them into

the Digital Ledger. In the future the deputy record keeper might directly

use the Digital-Ledger.

|

|

Savings Sheet

|

|

|

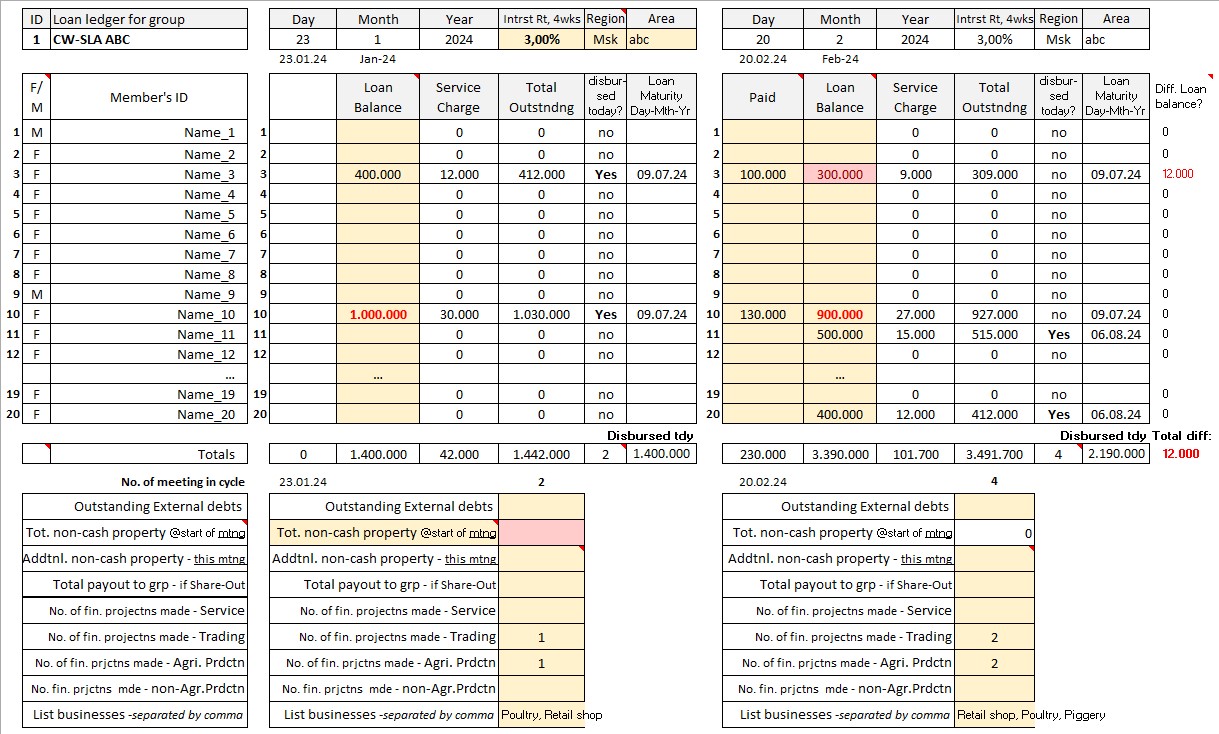

All

white cells are calculated by the tool. Golden cells are to be filled by

the user. User cells appearing in red indicate a mistake.

Cell comments suggest how to possibly resolve the respective error.

|

|

|

Loan sheet

|

|

|

Share-out Template for

automated calculations

|

|

|

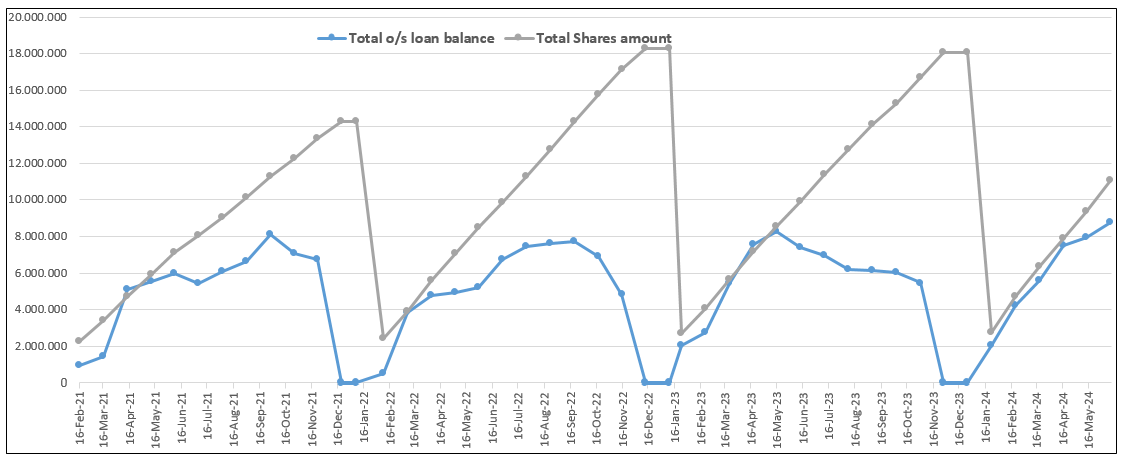

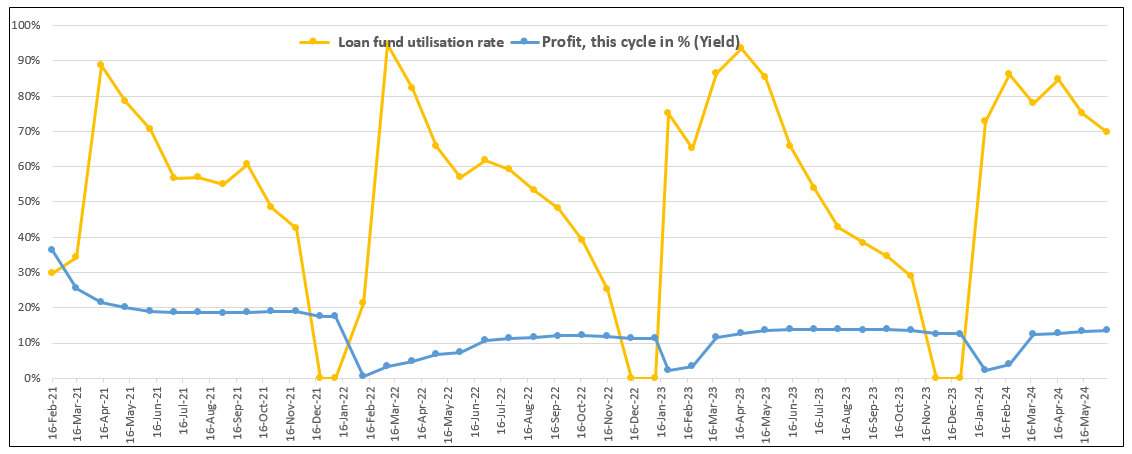

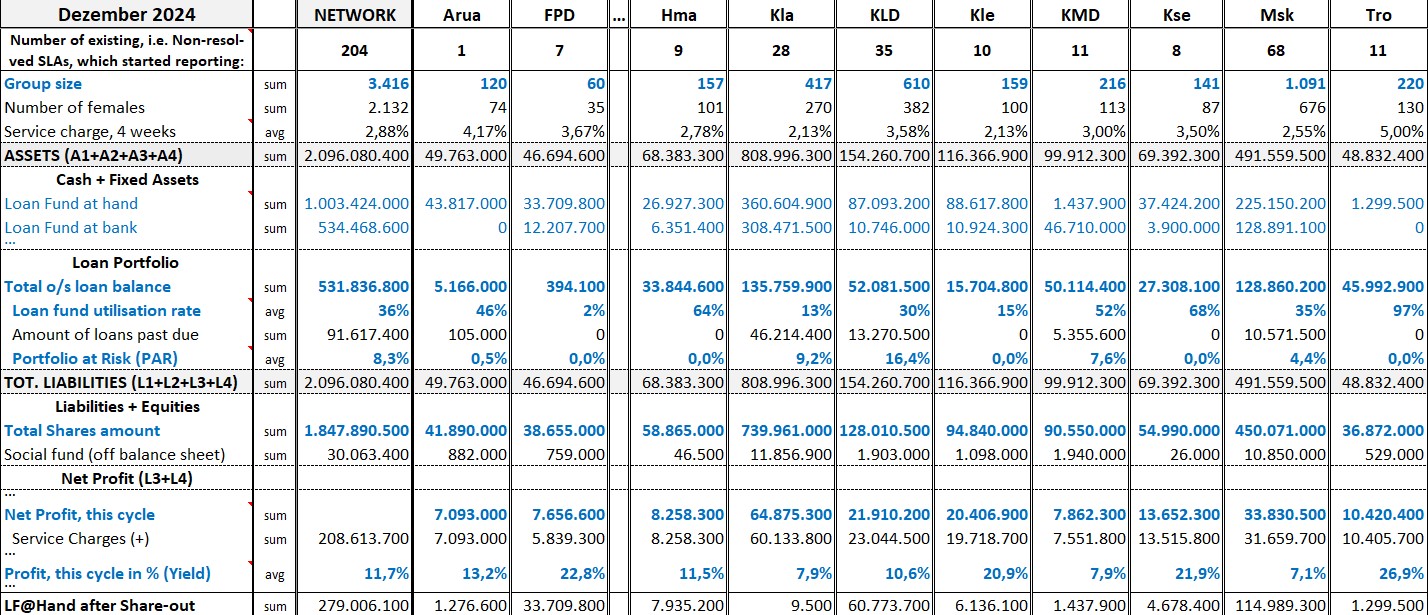

Remote Monitoring &

Evaluation on regional level: The regional supervisor

·

Reads the Digital-Ledgers

of all existing R-SLAs in the region into the Regional Aggregation Tool

·

Checks in the resulting Regional

Report if there is any error

marked in red, not yet resolved by the internal auditors.

·

Analyses the performance

of each SLA by reading the graphs of key performance indicators over time.

This information enables him to better advise the

SLA to take the group to the next level.

|

|

|

Graphs of the group’s Key Performance Indicators over time

Cycle 9-12 of an R-SLA with 20

members and 3% interest rate on 4-weekly basis

|

|

From all regional reports submitted, the R-SLA

coordinator establishes the Internal

Audit Report on Tertiary Level:

|

|

|

|

|

|

|